Background

The European Union Insurance Distribution Directive (IDD) replaces the Insurance Mediation Directive (IMD). It aims to enhance consumer protection when buying insurance (including non-investment insurance, life insurance and insurance-based investment products) and to support competition between insurance distributors by creating a level playing field.

The Insurance Distribution Directive (IDD) was due to come into force on 23 February 2018 although the FCA released a statement on 21st December 2017 regarding the European Commission’s announcement of a proposal to push back the application date of the Insurance Distribution Directive (IDD) by seven months to 1 October 2018, following requests from the European Parliament and Member States for a postponement.

Delay or no delay, we all need to be up to speed on what the new directive entails, in particular regarding the requirement for the new Insurance Product Information Document (IPID).

What does the new directive say?

The IDD introduces enhanced requirements around information and conduct of business. These include:

- Additional knowledge and competency requirements for distributors

- Product oversight and governance requirements

- Disclosures around bundling of products

- Additional disclosure requirements for insurance-based investment products

- Mandated remuneration disclosures;

- And finally, one of the big changes is the need to produce the new Insurance Product Information Document (IPID) for non-life products. The IPID will be required to provide consumers with standard information for a policy, similar to a policy summary, prior to sale by 23 February 2018.

What is the IPID and what should it contain?

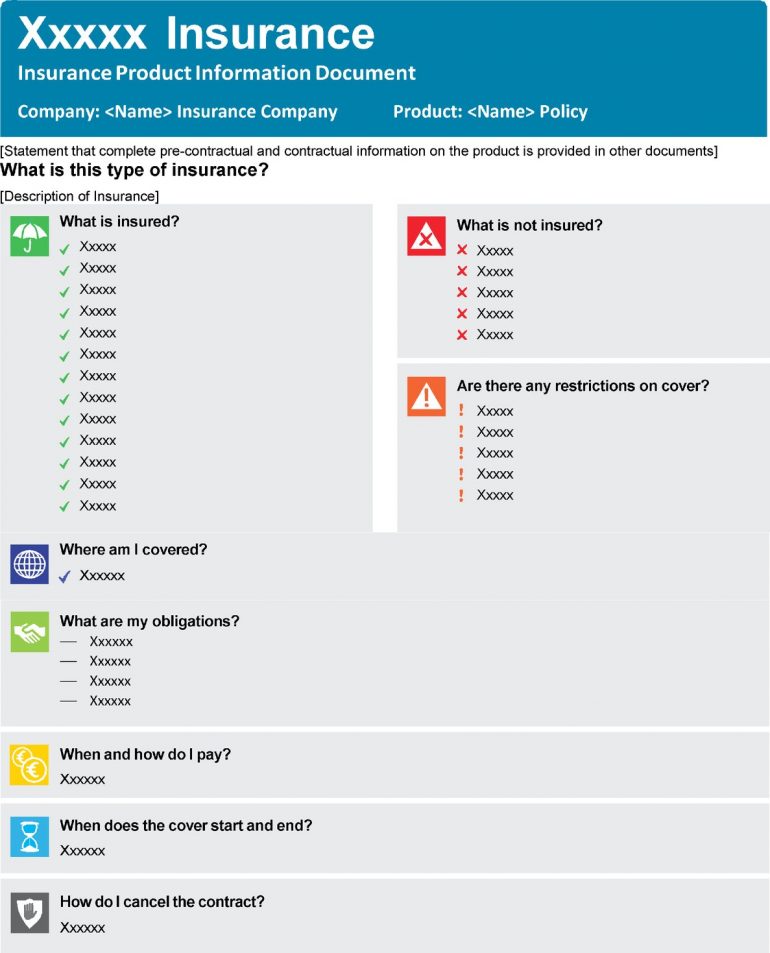

One of the IDD requirements is that the customer is given information in a standardised format, to enable them to make an informed decision about a non-life insurance product before they buy it. The manufacturer of the insurance product is responsible for producing the IPID.

Following consumer testing, European Insurance and Occupational Pensions Authority (EIOPA) developed draft Implementing Technical Standards (ITS) on a standardised presentation format for the IPID, which were submitted to the European Commission on 7 February 2017. These draft ITS have since been incorporated in Commission Implementing Regulation (EU) 2017/1469 of 11 August 2017 laying down a standardised presentation format for the IPID.

We’ve summarised what you need to include in your IPID;

- Title: the document must be titled ‘Insurance Product Information Document’.

- Name and company logo: it needs to clearly state the name of the manufacturer of the non-life insurance product, the Member State where the manufacturer is registered, its regulatory status and authorisation number; the company logo may also appear.

- Reference to complete pre-contractual and contractual information: it must make it clear that complete pre-contractual and contractual information about the product is provided to the customer in other documents.

- Length: the document should cover two sides of A4-sized paper when printed; in exceptional circumstances (which will need to be evidenced) it can run to a maximum of three.

- Presentation and order of content: the document must follow a standardised presentation format. The regulation details prescriptive requirements around font size; the sections to include (and their length and order); the way that information is set out; and specific rules for documents presented digitally.

- Language: the insurance product information document must be drafted in plain language and focus on the key information the customer needs to make an informed decision.

- Headings: the directive stipulates set headings, along with the information that needs to sit under each one.

- Use of icons: set icons need to be used that ‘visually represent the content of the respective section heading’. The regulations dictate the icons to use for each area of the report, along with their colours.

EIOPA has worked with the European Commission to develop an editable version of the IPID template in all official languages of the EU where you can download the template and icons.

Further information:

Member States (including the UK) will still be required to transpose the IDD into national law by the original date. However, under the current proposals, firms will not be required to comply with the IDD until 1 October 2018. The European Parliament and the Council will need to agree and confirm the new application date in an accelerated legislative procedure.

Sources:

EIOPA

EIOPA is an independent advisory body to the European Commission, the European Parliament and the Council of the European Union. It is one of the EU Agencies carrying out specific legal, technical or scientific tasks and giving evidence-based advice to help shape informed policies and laws at the EU and national level.

FCA